Whereas sunk prices may be thought of fastened costs, not all fastened prices are considered sunk. For instance, a fixed price is not sunk if a bit of equipment that an organization purchases could be sold to another person for the unique buy price. For example, let’s say that Company ABC has a lease of $10,000 a month on its manufacturing facility and produces 1,000 mugs per 30 days.

Understanding fixed costs is essential for small business owners as they symbolize ongoing monetary commitments that should be met irrespective of business exercise ranges. The CEO’s wage is likey to rise in line with basic wage will increase, nevertheless it stays a hard and fast cost. By way of distinction, variable prices improve or decrease consistent with learner numbers.

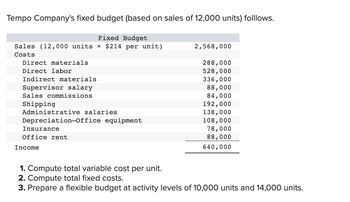

Marginal prices can embody variable costs as a end result of they’re part of the manufacturing course of and expense. Variable costs change based mostly on the extent of manufacturing, which means there might be also a marginal price within the total value of production. On the other hand, administrative bills refer to the indirect prices of running a enterprise, similar to rent, utilities, and salaries of administrative employees.

Another main fastened and indirect price is salaries for administration. Fastened costs are allotted within the oblique expense part of the income assertion, which leads to working profit. Depreciation is a common mounted expense that’s recorded as an oblique expense.

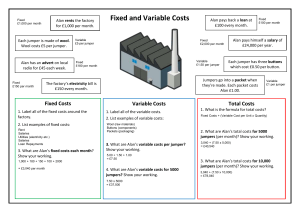

- These prices stay fixed over a selected period, similar to hire, insurance, or salaries.

- If workers work various hours during a particular period, their bills shall be variable.

- A business can also have discretionary bills such as presents, vacations, and leisure costs.

- For instance, a set value is not sunk if a chunk of equipment that a company purchases may be bought to another person for the unique purchase value.

These are fascinating, but you presumably can choose whether or not to have them or not. Dialed In Bookkeeping presents bookkeeping, powerful financial reporting, and advisory services to businesses in the house https://www.simple-accounting.org/ providers business. E-book a free name with Dialed In Bookkeeping right now to get started. Fixed wage ensures stability, while variable salary provides progress potential. A mix of both is ideal for balancing safety and flexibility.

B Examples Of Variable Labour Costs

To get a grip on your corporation costs, you need to know how to crunch the numbers and maintain them in verify. When business booms, you would possibly have to shell out additional for these long hours. Strive Docelf today and see how straightforward it’s to manage prices and maintain your business rising. Organizations must balance internal equity – making certain fair compensation across the group – with external competitiveness.

From the angle of human assets (HR), effective salary administration entails developing compensation constructions that align with market rates and organizational objectives. HR professionals should consider components similar to job roles, industry standards, and geographical location when figuring out wage scales. Moreover, they want to guarantee fairness and equity in pay across the organization, which can be achieved through common salary audits and adjustments. Developments in HR expertise may help in more accurate forecasting and management of wage costs.

How Are Fixed Costs, Including Salaries, Calculated?

It is essential to understand the differences between wages and salaries to know if they are variable or fastened. Both costs are a part of the payroll expenses for an employer. Most of the time, folks think about wages a variable value whereas classifying salaries as fastened. Primarily, wages can classify as a semi-variable price.

Mounted prices are bills that a enterprise incurs regardless of its production or gross sales quantity. These prices remain fixed over a selected timeframe or exercise level, making them predictable and important for a company’s monetary planning. Fixed costs are also referred to as fixed bills or overhead bills.

When workers work more, they may receive larger wages. The major difference between salaries and wages is the fastened component. Often, the salaries paid to staff remain fixed regardless of hours labored.

Break-even Analysis And Profit Margins

Nevertheless, if the corporate doesn’t produce any hats, it won’t incur any variable prices for the manufacturing of the hats. Similarly, if it produces 1,000 hats, the variable cost would rise to $5,000. The extra mounted costs an organization has, the more revenue a company must generate to have the ability to break even, which implies it needs to work more durable to supply and sell its products. That Is as a result of these prices happen regularly and barely change over time.